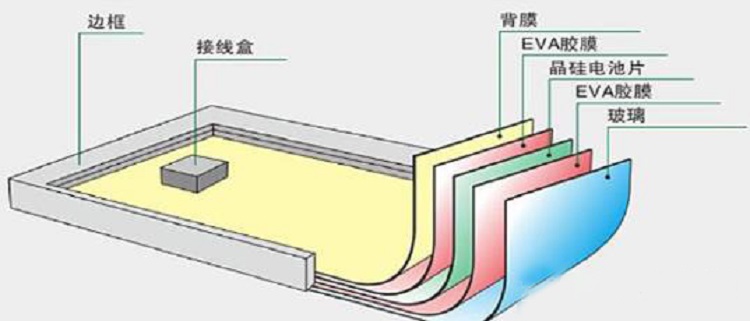

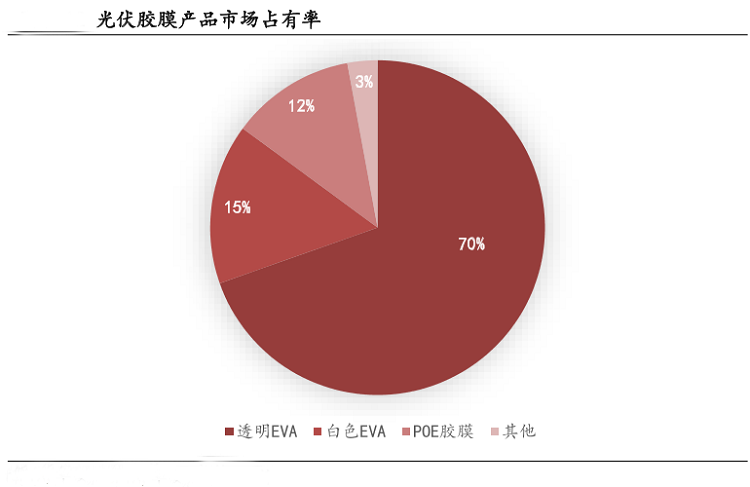

Photovoltaic film is an indispensable part of solar panel components, accounting for about 8% of the cost of solar panel components, of which EVA film is currently the highest proportion of film products. With the release of new production capacity of silicon materials in the fourth quarter to promote the growth of component demand, and the fields such as cables and foams are gradually entering the peak season, analysts predict that the price of EVA is expected to hit a new high this year.  In the first half of this year, the domestic EVA production was about 780,000 tons. Due to the increase in the localization rate and the tight supply and demand of overseas EVA, the domestic EVA import volume from January to May this year was 443,000 tons, down 13% year-on-year. Guosen Securities estimates that the annual domestic EVA production is 1.53 million tons, the import is 1 million tons, and the annual domestic supply is 2.43 million tons. According to the annual photovoltaic installed capacity forecast of 235GW, the annual EVA demand is about 2.58 million tons, of which the photovoltaic grade demand is 120 tons. tons. The annual gap is 150,000 tons. It is expected that the gap will be larger in Q4, and the EVA price is expected to rise more than expected. Guosen Securities pointed out that according to the calculation of 235/300/360GW of newly installed capacity in 2022-2024, the demand for EVA will be 120/150/1.8 million tons respectively, the demand side is still more likely to exceed expectations.

In addition, industry data shows that the market price of photovoltaic grade trichlorosilane reversed on August 9. When the maintenance of the downstream polysilicon factory was about to end, the market price of photovoltaic grade trichlorosilane increased by 1,000 yuan / ton, and the price was about 20,000 yuan. Yuan/ton, up 5.26% month-on-month.

Trichlorosilane is an important chemical basic material. Trichlorosilane is required for new production capacity and normal production process of polysilicon. With the rapid growth of the photovoltaic industry, photovoltaic polysilicon has accounted for 6-70% of the demand for trichlorosilane. The rest are mainly original markets such as silane coupling agents. In 2022, the new domestic production capacity of silicon material will be about 450,000 tons. The increase in silicon material production and the incremental demand for trichlorosilane caused by the new operation of silicon material will exceed 100,000 tons. The announced expansion of silicon material production in 2023 Larger, China Merchants Securities estimates that the incremental demand is theoretically more than 100,000 tons. At the same time, the traditional market of silane coupling agent, trichlorosilane, remained stable and rose. The domestic production capacity of trichlorosilane has remained stable in recent years. The current overall production capacity is nearly 600,000 tons. Considering the progress of commissioning and the actual operating rate, the total domestic supply of trichlorosilane will exceed 500,000 to 650,000 tons this year and next. The analysis of China Merchants Securities pointed out that from this year to the first half of next year, the supply and demand pattern of trichlorosilane is still tight or in a tight balance, and there may be a staged supply gap in the second half of this year.  According to EVA film and trichlorosilane, the supply trend of this kind of raw materials, our Multifit will further strengthen the relationship with the suppliers who produce these raw materials to ensure that the production cost of our photovoltaic panels is maintained to a competitive level. power price.

|

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China +86-0754-81888658

+86-0754-81888658 multifit@multifitele.com

multifit@multifitele.com