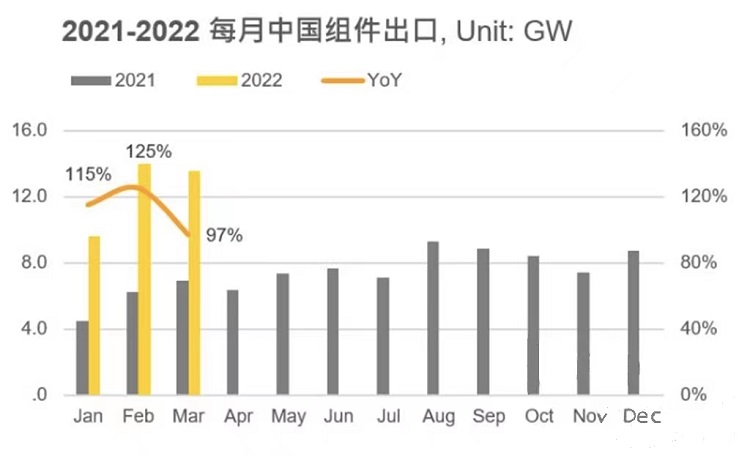

From January to March 2022, China exported 9.6, 14.0, and 13.6GW of photovoltaic modules to the world with a total of 37.2GW, an increase of 112% compared with the same period last year, and almost doubled every month. In addition to the continuing wave of energy transition, key markets growing in the first quarter of 2022 include Europe, which must accelerate the replacement of traditional energy sources amid the Ukraine-Russia conflict, and India, which began imposing Basic Customs Duty (BCD) tariffs in April this year.

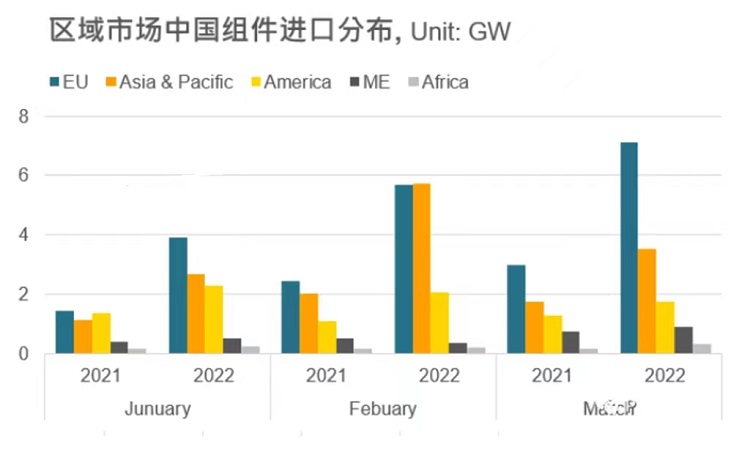

Europe, which has been the largest market for Chinese module exports in the past, imported 16.7GW of Chinese module products in the first quarter of this year, compared with 6.8GW in the same period last year, a year-on-year increase of 145%, which is the region with the highest year-on-year growth. Europe itself is the most active market for energy transition. Governments of various countries continue to release policies that are favorable to the development of renewable energy. The new national government also accelerates the development of renewable energy after taking office. The recent Ukrainian-Russian conflict has greatly affected European energy policies. In order to expedite the elimination of oil and natural gas dependence on Russia, countries have begun to plan and accelerate the deployment of renewable energy. Among them, the fastest progress is represented by Germany, a major energy-consuming country. Germany is currently The timetable for the full use of renewable energy has been advanced to 2035, which will greatly stimulate the demand for photovoltaic products this year and in the future. Europe's high demand for renewable energy has also made it more acceptable to increase module prices. Therefore, in the first quarter when supply chain prices continued to rise, Europe's demand for photovoltaic products continued to grow month by month. At present, the markets that have imported more than GW-level modules from China include the Netherlands, Spain and Poland.

Asia-Pacific

China's exports to the Asia-Pacific market also grew rapidly in the first quarter. At present, it has accumulated 11.9GW of Chinese module exports, an increase of 143% year-on-year, making it the second fastest growing market. Different from the European market, although some Asian countries have grown compared with last year, the main source of module demand is India, a single market. India imported 8.1GW of modules from China in the first quarter, an increase of 429% year-on-year from 1.5GW last year. The growth rate is quite significant. The main reason for the hot demand in India is that the Indian government began to levy BCD tariffs in April, levying 25% and 40% BCD tariffs on photovoltaic cells and modules respectively. Manufacturers rushed to import a large number of photovoltaic products to India before the BCD tariff was imposed. , resulting in unprecedented growth. However, after the imposition of tariffs, it is expected that the import demand in the Indian market will begin to cool down, and China's exports to India accounted for 68% of the Asia-Pacific market in the first quarter, and a single country has a greater impact, and the Asia-Pacific market may start to show more obvious changes in the second quarter. decline, but will still be the world's second largest export demand market. As of the first quarter, China's exports to the Asia-Pacific market exceeded GW-level countries including India, Japan and Australia.

Americas, Middle East and Africa

Americas, Middle

East and Africa

The Americas, the Middle East and Africa imported 6.1, 1.7 and 0.8GW of modules from China respectively in the first quarter of this year, with year-on-year growth of 63%, 6% and 61%, respectively. Except for the Middle East market, there was also significant growth. Brazil, a major PV demander, is still driving the American market. Brazil imported a total of 4.9GW of PV modules from China in the first quarter, an increase of 84% compared with 2.6GW last year. Brazil has benefited from the current tax-free policy for imported PV products and continues to It is China's top three component export markets. However, in 2023, Brazil will begin to impose corresponding fees on distributed projects, which may cause a wave of hot demand like India before the imposition of BCD tariffs.

look

The wave of energy transition and corporate social responsibility continues, and the global demand for renewable energy continues to increase, accelerating the deployment of photovoltaics. In 2022, the global demand for non-Chinese photovoltaic modules will be conservative at 140-150GW, and it can even reach more than 160GW under optimistic conditions. The main export markets are still Europe and the Asia-Pacific region, which are promoting the fastest energy transition, and Brazil, whose monthly export volume exceeded GW in the first quarter.

Although the overall market prospects are promising at present, it is still necessary to pay attention to whether the supply chain price increase and blockage caused by the current upstream and downstream capacity mismatch of the overall photovoltaic supply chain and the epidemic control and control will cause the delay or reduction of the demand for price-sensitive centralized projects; And whether the trade barriers caused by the trade policies of various countries will directly impact the demand for photovoltaic products in 2022. |

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China +86-0754-81888658

+86-0754-81888658 multifit@multifitele.com

multifit@multifitele.com