Under the general trend of global energy green transformation, the new energy industry has ushered in unprecedented development opportunities. Photovoltaic market demand at home and abroad has a broad prospect, and the installed photovoltaic demand at home and abroad has maintained a high boom in the first quarter.

External development of China's photovoltaic industry in the first quarter of 2022

●Polysilicon import shows price increment decrease trend

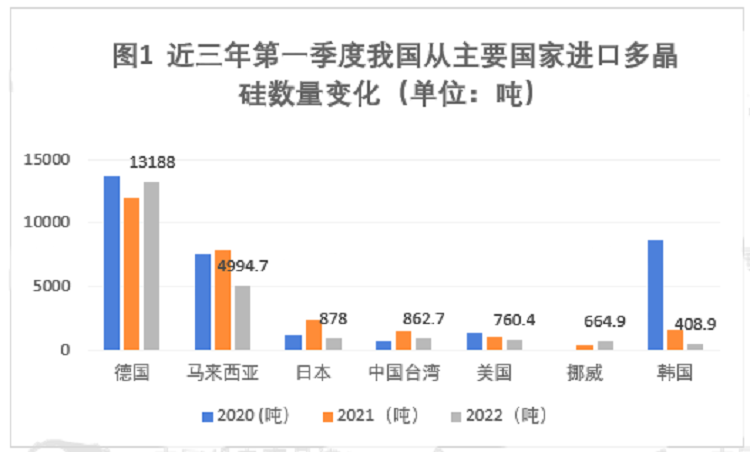

In the first quarter of 2022, China's domestic polysilicon production was about 159,000 tons, up 32.5 percent year-on-year. The imported polysilicon reached us $660 million, up 125.3% year on year. The import volume was 22,000 tons, down 18.1% year on year. Import prices show a trend of incremental reduction. Affected by the epidemic and the conflict between Russia and Ukraine, logistics costs and raw materials such as silicon materials have risen sharply

In the first quarter, China's main import sources of polysilicon are Germany, Malaysia, the United States, Japan and Taiwan, accounting for 97.4% of China's polysilicon import market. Germany is China's largest polysilicon import source, accounting for 64.3%. Polysilicon imported from Germany reached 420 million US dollars, up 221.1% year on year. The import volume was 13,000 tons, up 10.2% year on year. Polysilicon imported from Malaysia amounted to $150 million, up 69% year on year. The import volume was nearly 5,000 tons, down 36.3% year on year. It is second with 22.4 percent. Polysilicon imported from the United States amounted to $0.3 billion, 69% year-on-year; Import 760.4 tons, down 28.3% year on year; Third place with a 4.3% share.

● China's export of silicon wafer increased by 65%

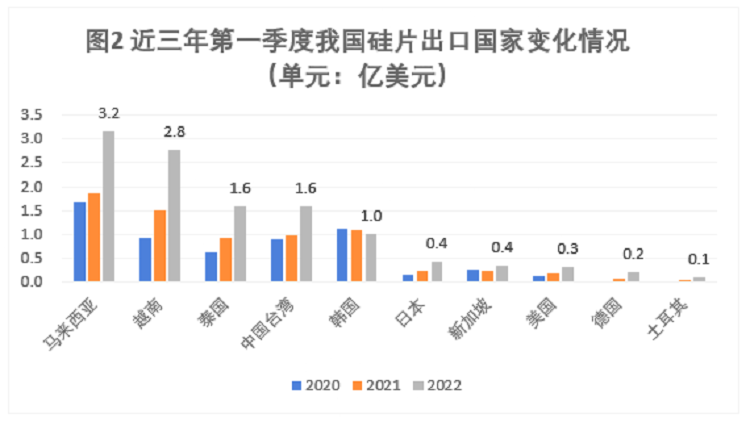

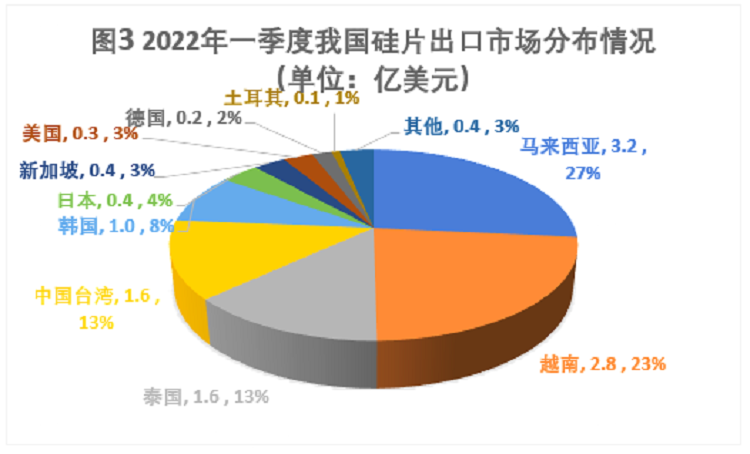

In the first quarter of 2022, domestic pv wafer production is expected to be about 70GW, up about 40.8% year-on-year. Wafer exports exceeded $1.19 billion, up 60.3% year on year.

Malaysia, Vietnam and Thailand are important overseas export destinations of China's silicon wafers, with exports of 760 million US dollars, up 74% year-on-year, accounting for more than half of China's overseas market share. Exports to Malaysia were 320 million US dollars, up 68.6% year on year, ranking the first place. Exports to Vietnam were $280 million, up 84.5% year on year, ranking second. Export to Thailand 160 million DOLLARS, up 68.6% year on year, ranked the third. In addition, the export to Cambodia surged in the first quarter, from $480 in 2021 to $2.644 million, mainly because of the impact of the United States launched anti-circumvention investigation against Malaysia, Vietnam, Thailand and Cambodia on March 28, it is expected that the export of Chinese silicon wafers to the above four countries may show a declining trend in the second quarter.

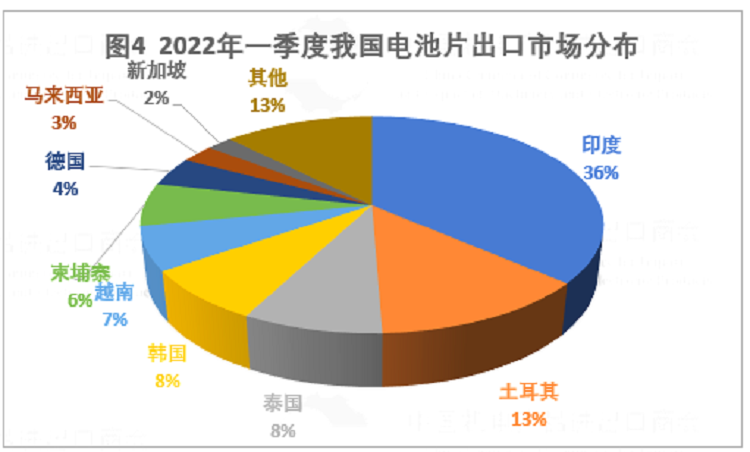

●Exports of Chinese batteries to India and Turkey surged

In the first quarter of 2022, China exported $830 million of photovoltaic cells. In the first quarter, China's top five export markets for batteries were India, Turkey, Thailand, South Korea and Vietnam, accounting for 72% of China's battery export market.

Among them, the export of pv cells to India is $300 million, accounting for 36% of the market share, ranking the first. The main reasons are as follows: After The official announcement that India will impose basic tariff on PV cells from April 1, Indian importers rush to import before the rise of pv costs; Exports of pv cells to Turkey amounted to $110 million, accounting for 13% of the market, ranking second. The main reasons are as follows: on the one hand, in 2021, Turkey will add 1.14GW of photovoltaic installations, and rooftop photovoltaic ushered in vigorous development and strong demand; on the other hand, Turkey started the first sunset anti-dumping review investigation on photovoltaic modules originating from China, but did not initiate anti-dumping on batteries, so Turkey increased the import of batteries.

|

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China

6 Keji west road. Hi-Tech Zone Shantou City, GuangDong,China +86-0754-81888658

+86-0754-81888658 multifit@multifitele.com

multifit@multifitele.com